Business Loan Options for New Companies

Are you aware of starting a new business? Starting a new business takes a vision, dedication, and, perhaps most important, capital. Funding is often one of the most complicated parts of starting a new business. The funding options available today can provide financing for new businesses, and whether you are looking for some fast cash or a source of ongoing funding, knowing your options can give you direction when making decisions about the next steps of the growth of your business!

The Challenges of Funding a Startup

Traditional lenders can be hesitant to work with new companies. Limited operating history, lack of collateral, unproven business models, and lower credit scores often make approval for small business loans difficult. That’s why exploring alternative financing methods is key for early-stage entrepreneurs.

Below are some of the most common, and practical, ways to fund a new business.

1. Small Business Administration (SBA) Loans

SBA loans are backed by the U.S. Small Business Administration, which guarantees a portion of the loan, reducing risk for lenders. This makes them one of the most accessible forms of traditional financing for startups.

- SBA 7(a) Loans – Flexible, with funding up to $5 million for working capital, real estate, or debt refinancing.

- SBA Microloans – Up to $50,000 for smaller needs like inventory or equipment, often with added technical support.

- SBA CDC/504 Loans – Designed for major asset purchases, such as property or machinery.

Pros: Low interest rates, long repayment terms.

Cons: Lengthy application process, strict eligibility requirements.

2. Business Credit Lines

A business line of credit offers flexible access to funds, you borrow only what you need and pay interest solely on that amount. This makes it ideal for managing cash flow or covering unexpected expenses.

- Secured lines require collateral, like receivables or inventory.

- Unsecured lines don’t require collateral but may have higher rates.

Pros: Flexibility, only pay for what you use.

Cons: Possible variable rates, smaller limits for startups.

3. Equipment Financing

If your business needs machinery, vehicles, or technology, equipment financing can help you purchase them without draining your cash reserves. The equipment itself serves as collateral, making approval easier for newer companies.

Pros: Easier to qualify, preserves working capital.

Cons: Limited to equipment purchases, total cost depends on terms.

4. Merchant Cash Advances (MCAs)

With an MCA, you receive a lump sum in exchange for a portion of future credit card sales. While this can provide fast funding, the costs are often much higher than other options.

Pros: Quick approval, repayment tied to sales volume.

Cons: High fees, can strain cash flow.

5. Invoice Financing

Invoice financing lets you sell unpaid invoices to a third party at a discount in exchange for immediate cash.

Pros: Improves liquidity without new debt, easier approval.

Cons: Fees can be high, potential loss of control over collections.

6. Crowdfunding

Platforms like Kickstarter or Indiegogo allow you to raise funds from many contributors in exchange for rewards, equity, or repayment. Beyond funding, crowdfunding can validate your idea and build early customer interest.

Pros: Builds community, avoids traditional debt.

Cons: Requires significant marketing, no guarantee of success.

7. Angel Investors and Venture Capital

These sources exchange funding for equity in your company; while competitive to secure, they can bring substantial resources and valuable mentorship.

Pros: Large capital injections, networking benefits.

Cons: Loss of some ownership, pressure for rapid growth.

8. Personal Loans for Business

For very early-stage ventures, a personal loan may be the fastest route to funding, though it carries more personal risk.

Pros: Easier approval if you have strong personal credit.

Cons: Impacts personal credit, puts personal assets at risk.

9. Business Credit Cards

While not a substitute for long-term financing, business credit cards can cover short-term expenses and help you build credit for future online business loans.

Pros: Convenient, potential rewards.

Cons: High interest if balances are carried, risk of overspending.

How to Choose the Right Loan

Before applying for business loans, consider:

- How much funding you need and why.

- Your repayment ability and cash flow stability.

- Total borrowing costs, including fees.

- The lender’s eligibility requirements.

- How quickly you need the funds.

Preparing to Apply

To improve your approval odds:

- Build a strong business plan.

- Keep financial records organized.

- Strengthen your personal credit score.

- Identify collateral if applicable.

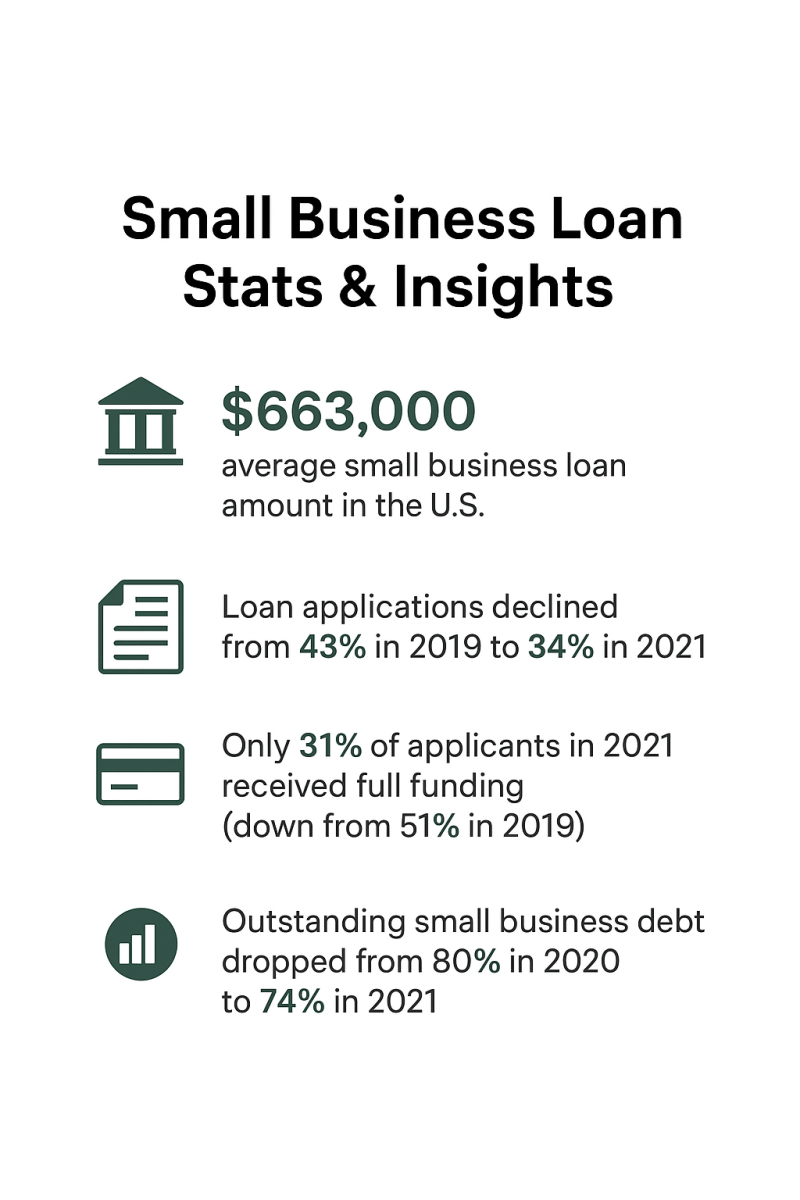

Loan Stats & Insights for New Businesses

- $663,000 is the average of small business loan amounts in the U.S.

- Loan applications have declined from 43% in 2019 to 34% in 2021.

- While only 31% of applicants in 2021 received the full amount requested (down from 51% in 2019).

- Alternative financing options like crowdfunding, peer-to-peer lending, and fintech are gaining popularity.

- Outstanding small business debt dropped from 80% in 2020 to 74% in 2021.

Source: Federal Reserve & Forbes

Bottom line: While securing financing as a new company can be challenging, today’s mix of traditional and alternative funding options makes it possible to find the right fit. By researching your choices and preparing thoroughly, you can give your startup the best chance to secure the capital it needs to grow.