Georgii Dubovyi on Financial Policy: How to Manage Profits in Business

Abstract: This article is devoted to financial policy and profit management in business, with an emphasis on micro, small and medium enterprises and the retail sector. The objective of the study is to identify the main aspects of effective financial management, including theoretical foundations such as agency and signaling theory, as well as the importance of profit sustainability and cash availability.

The objectives include analyzing the impact of sustainable practices on the financial performance of retailers and determining the importance of training MSME owners in financial accounting. The results of the work show that sound financial policy helps maximize revenues and minimize risks, ensuring business stability.

The practical application of the results lies in developing strategies to improve financial literacy and implement sustainable practices in retail, which meets the modern requirements of consumers and regulators. These approaches will help companies not only adapt to market changes, but also achieve long-term growth and sustainable development.

Financial policy is one of the key aspects of successful business management. It determines how a company plans, controls, and utilizes its financial resources to achieve its goals. In an environment of constant market changes and growing competition, effective profit management becomes especially relevant. Proper financial strategies help not only maximize revenue but also minimize risks, ensuring business stability and sustainability.

Theoretical Foundations of Profit Management in Business:

-

Agency Theory – According to this theory, resource owners (principals) and managers (agents) enter into an agreement to manage a company with the goal of maximizing profit. Managers, who have decision-making authority, may use different approaches to achieve this objective. It is crucial that their actions align with the interests of the principals, including optimizing the tax burden through effective tax management.

-

Signaling Theory – Profit quality serves as an important signal for investors, reducing information asymmetry and mitigating risks. High-quality profits strengthen a company’s reputation, whereas earnings manipulation can lead to distrust and negatively impact stock prices. For instance, if a company recognizes unrealized revenue, it may create a false perception of its financial health, ultimately damaging investor confidence.

-

The Impact of Profit Stability on Profit Quality – A high level of profit stability allows investors to better predict future earnings, leading to more informed investment decisions. In other words, the more stable a company’s profit, the higher its quality.

-

The Role of Cash Availability – Sufficient cash reserves help companies reduce external financing costs and avoid financial difficulties. Managers are particularly interested in free cash flow, which ensures liquidity and operational stability. This, in turn, contributes to higher profit quality.

-

Accounting Conservatism – This principle promotes a cautious approach to financial reporting, which can enhance profit quality. However, conservatism does not always mitigate the impact of profit stability and cash availability on profit quality, as conservative accounting methods may not fully reflect actual cash flows or account for various factors influencing profitability.

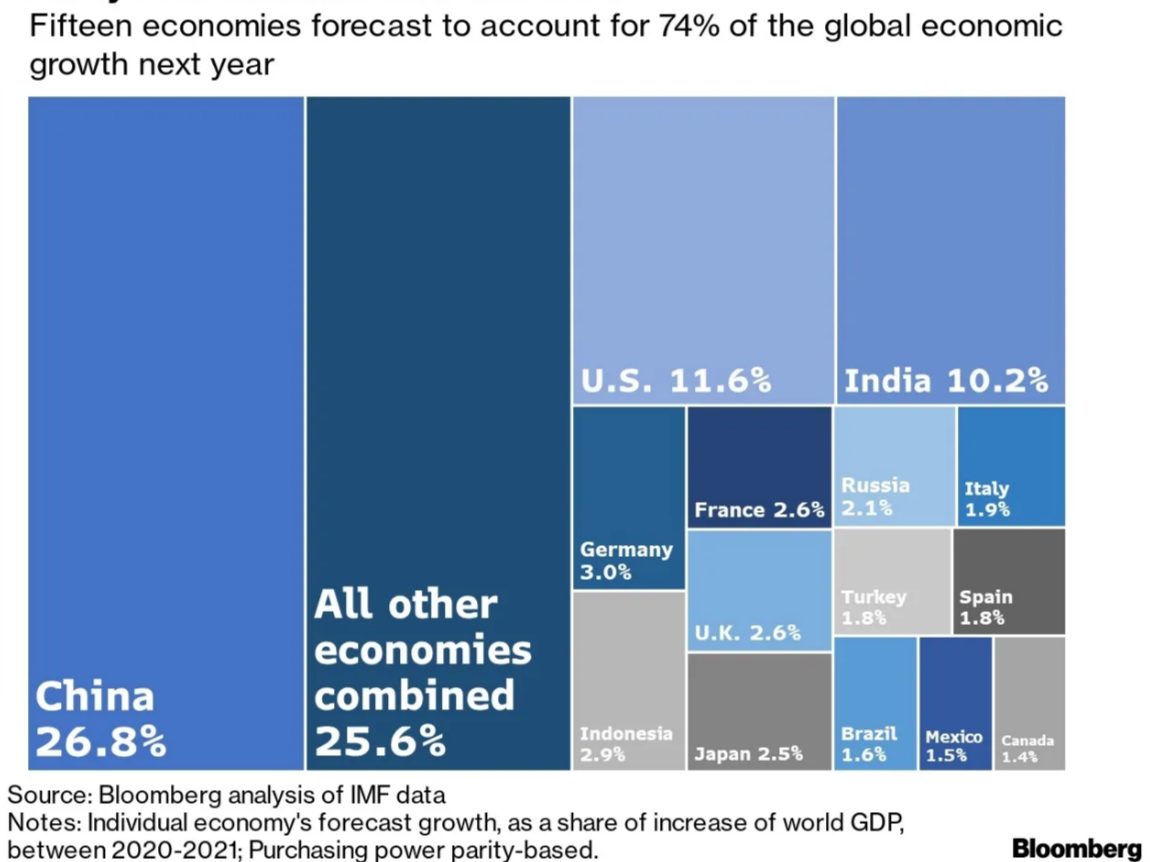

The retail sector in the global economy drives consumer demand and creates jobs. In 2021, the global market volume exceeded $25 trillion, and significant growth is expected in the next decade (Statista, 2022). However, retail is also a major source of environmental issues, including waste, greenhouse gas emissions, and excessive resource consumption.

In response to increasing focus on sustainability and regulatory pressure, retailers are implementing sustainable practices such as responsible sourcing, energy efficiency, and waste reduction. Changing consumer behavior is also crucial: more people, especially Millennials and Generation Z, are choosing brands that prioritize environmental responsibility. This creates competitive advantages for companies that emphasize social and environmental issues.

Many retailers are adopting sustainable practices to attract conscious consumers and align with global environmental goals, such as the United Nations’ Sustainable Development Goals. Regulatory requirements, such as the EU Circular Economy Action Plan, encourage sustainable production practices and product lifecycle management. In the U.S., for instance, California laws restrict plastic use and promote recycling, forcing retailers to rethink their business practices. These changes create new opportunities and challenges for retailers, requiring innovative approaches to profit management. As sustainability and environmental responsibility gain importance, companies must adapt their financial strategies to effectively manage profits in a shifting business landscape [2].

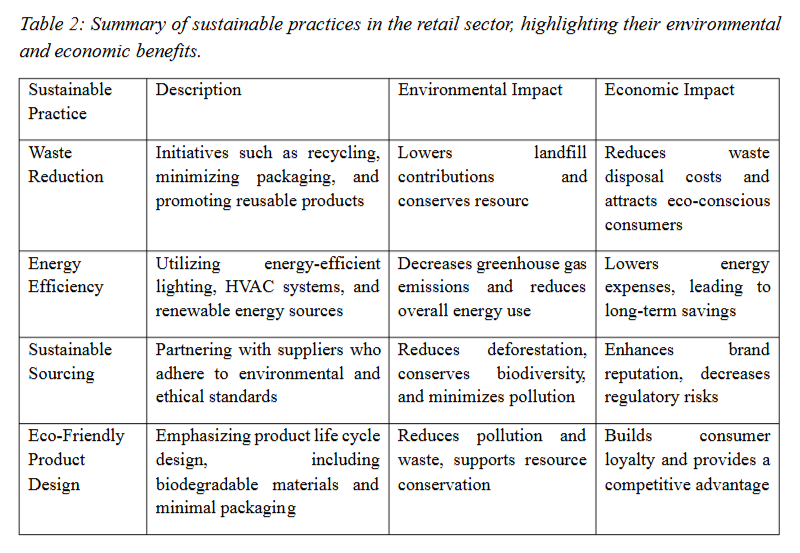

Sustainable Sourcing as a Factor in Business Financial Policy

Selecting suppliers that comply with ethical and environmental standards reduces negative environmental impact and minimizes risks associated with regulatory requirements and consumer preferences. Retailers actively integrate these practices, increasing supply chain transparency.

Waste Reduction and Circular Economy

Retailers implement recycling and material reuse programs, reducing costs and attracting sustainability-focused consumers. These initiatives enhance operational efficiency and decrease resource dependency.

Energy Efficiency and Carbon Footprint Reduction

Investments in energy-saving technologies and renewable energy sources lower operational costs and help reduce carbon emissions. These measures contribute to both environmental sustainability and long-term economic benefits.

Eco-Friendly Product Design

Companies develop environmentally friendly products and biodegradable packaging, meeting the growing demand for sustainable solutions. This improves brand image and fosters customer loyalty, positively impacting financial performance [2].

The Role of Micro, Small, and Medium Enterprises (MSMEs)

Micro, small, and medium enterprises play a crucial role in the economy by creating jobs and providing services. Often family-run, they contribute to economic stability but face challenges in marketing, human resource management, and access to financing. These enterprises are classified based on net worth or annual sales volume, influencing their status and support eligibility. While they make significant contributions to GDP and employment, many struggle due to a lack of managerial skills and financial management knowledge.

Effective financial management, including accounting, is critical to MSME success. It helps track revenues and expenses, optimize costs, and make informed decisions. However, owners often focus on production and sales while neglecting financial accounting, leading to a lack of awareness about actual profits and losses. Training in accounting fundamentals, financial reporting, and cost analysis can improve business owners’ financial literacy. Continuous support and post-training monitoring help integrate this knowledge into daily operations [3].

Strategic Profit Management in Business

Profit management in business is not just a task but a strategic process that requires careful planning and a deep understanding of financial mechanisms. An effective financial policy allows entrepreneurs to control current revenues and expenses, plan for future growth, invest in new projects, and adapt to market changes. It is essential to recognize that successful profit management results from a comprehensive approach, including sound budgeting, financial performance analysis, and continuous education. By applying these principles, companies can not only survive in a competitive environment but also achieve significant growth and long-term prosperity.

References

-

Herdiansyah D., Suripto S. The effect of profit persistence and cash holding on profit quality with accounting conservatism as moderation. – International Journal of Accounting Management Economics and Social Sciences (IJAMESC). – 2024.

-

Sivaprasad K.I. Sustainable Business Practices in the Retail Sector: Balancing Profit with Environmental Responsibility. – International Journal of Commerce, Management, Leadership, and Law. – 2024.

-

Herianti E., Marundha A., Nugrahanti T.P., Tarigan K. Financial management education for MSMEs as a tool to determine business profit and loss. – Abdi Dosen Jurnal Pengabdian Pada Masyarakat. – 2024.

Author of the article: Georgii Dubovyi. Startup Business Developer.