Why Modern Consumers Prefer Financial Systems With Less Friction

People have gradually come to expect fast responses from nearly every digital tool they use, and this expectation quietly shapes how they approach their finances. When a transfer stalls or a small action requires several screens of confirmation, the delay feels more intrusive than it once did.

Many daily routines already involve juggling messages, tasks, and scheduling, so anything that interrupts the flow stands out. This shift happened slowly, almost without notice, as people grew comfortable with immediate results. What formerly felt like a normal wait now lands as an unnecessary pause, especially when the rest of their digital interactions move freely.

Legacy Processes That Slow Things Down

Much of the traditional banking system still relies on procedures that were built during years when paperwork and manual review were the only ways to confirm details. Those steps linger, even as the pace of everyday life has accelerated. Something as simple as updating personal information or sending money abroad may require repeated identity checks or a series of approvals that feel overly cautious. Users may understand why these routines exist, yet the frequency and repetition wear them. After enough experiences like this, people naturally start comparing these older processes to the smoother tools they use elsewhere, and the difference becomes difficult to ignore.

Convenience in Digital Entertainment

Digital entertainment provides a clear view of how convenience influences financial decisions because the activity and the payment are often intertwined. Streaming services rely on quick renewals, game platforms expect instant purchases, and online casinos operate with the assumption that players want minimal delays.

Some users are drawn to systems such as no verification casinos, not because they avoid oversight entirely, but because these platforms let them deposit and withdraw without searching for documents each time, while still recording transactions through blockchain tools. This approach appeals to individuals who prefer a straightforward experience, where the financial side behaves predictably and doesn’t overshadow the activity they came for.

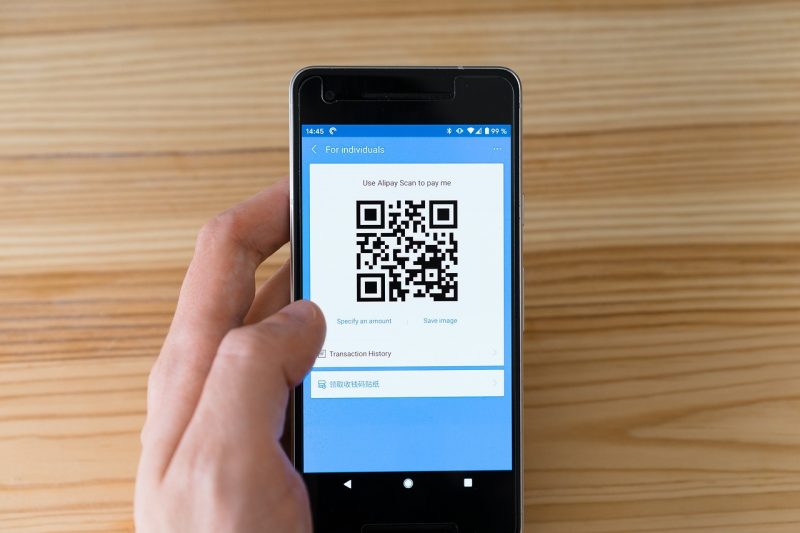

Everyday Use of Instant Payment Tools

More than 53% of Americans claim to use mobile wallets more frequently than traditional payment methods. This goes to show how mobile wallets and instant payment apps have quietly become part of daily life, in large part because they demand almost nothing from the user. Once installed, they turn routine moments like covering a shared meal, paying a neighbor back for a favor, or sending support to a family member into small, nearly automatic gestures.

This simplicity encourages people to keep using them, and the habit builds naturally. The more these tools blend into their routines, the less patience users have for traditional systems that still rely on slower processing. It becomes clear that people value tools that disappear into the background instead of requiring attention.

New Forms of Digital Trust

People’s sense of security around money has changed as digital authentication tools have grown more reliable and familiar. Encryption, fingerprint scans, and detailed activity logs give users a level of reassurance that doesn’t depend entirely on a bank’s name or a company’s history. These features let them move through financial tasks at a steady pace without feeling like they’re taking risks or skipping safeguards. Much of the protection now happens in the background through automated checks that once required staff members to review documents or confirm details.

As this becomes the norm, many users find themselves placing as much confidence in the technology running the system as in the institution offering it. That growing comfort helps them embrace faster processes because they no longer see speed and safety as competing priorities.

Practical Value of Faster Payments

People who rely on timely earnings notice the effect of slow payments more than most. Contractors, freelancers, gig workers, and remote staff often work with irregular schedules and clients across different time zones. When payments move slowly, they must reorganize their budgets and postpone plans.

A system that releases funds promptly offers stability that reduces stress and uncertainty. It lets individuals pay bills on time, cover unexpected costs, or respond to opportunities without waiting for transfers. This reliable flow influences their choice of financial tools, encouraging them to adopt platforms that match the pace of their professional and personal commitments.

Behind-the-Scenes Automation

Modern financial platforms often rely on automation that reviews transactions and verifies identities silently, which helps keep the visible process smooth. Machine learning tools track patterns, compare activity against expected behavior, and flag outliers without involving the user unless something genuinely needs attention. Many individuals never notice these checks happening, which becomes part of the appeal.

Identity verification, document analysis, and fraud monitoring take place in the background, creating a lighter experience. Users finish their tasks quickly, yet the system still maintains the protections needed to keep accounts safe, allowing speed and oversight to coexist more naturally than before.

User Experience Design in Financial Platforms

User experience design shapes how smoothly people move through financial tools, often matching the impact of the technology running underneath. Interfaces that feel intuitive, with clear pathways and sensible defaults, help users complete tasks like transferring funds, organizing payments, or checking balances without unnecessary steps. When these actions require less effort and fewer decisions, people feel more capable and less overwhelmed. Thoughtful design limits mental strain by showing only what matters in the moment. As a result, activities that once seemed complex become ordinary parts of a person’s routine, handled without hesitation.

Design also plays a quiet but meaningful role in building trust. Familiar visual patterns, steady feedback, and consistent interaction flows signal that the system is stable and functioning properly. Real-time updates, clear progress markers, and easily accessible help options ease tension during important transactions. Strong design also anticipates where users might stumble by streamlining repeated choices and preventing avoidable mistakes. This combination of clarity, efficiency, and reassurance helps explain why platforms that prioritize human-centered design tend to attract more users and maintain stronger loyalty than those that depend on back-end performance alone.

Borderless Lifestyles and Financial Barriers

A growing number of people spend their time across different countries, whether for work, family, or extended travel, and traditional banking systems often struggle with this level of mobility. A single international transfer may pass through several organizations, each adding a delay or small fee that eventually adds up. Individuals who rely on payments from multiple regions or who frequently move between locations feel these slow points most intensely.

Newer tools reduce many of these steps, making it easier to manage expenses without planning days ahead. They fit better with routines shaped by constant movement, allowing cross-border tasks to feel ordinary instead of cumbersome.

How Speed Strengthens Economic Activity

Given that companies accounted for 65.4% of 2024 real-time payment revenue, we can see that most organizations are prioritizing fast payments. That’s because businesses also benefit when money moves quickly because their operations depend on steady timing. When payments arrive without long waits, suppliers can be paid on schedule, staff compensation remains predictable, and unexpected costs become easier to manage. Smaller companies, especially those with tight margins, feel the difference sharply. When funds come through promptly, owners gain more freedom to make decisions based on long-term goals instead of reacting to temporary shortages. Over time, this consistency improves cooperation between partners and helps prevent small issues from turning into larger disruptions, strengthening the overall flow of commerce in ways that accumulate gradually.

Conclusion

Preferences for lower-friction financial tools have become part of everyday life because people rely on systems that match the pace of their routines. Reducing repeated identification checks, trimming unnecessary steps, and simplifying the movement of funds keep transactions from feeling like chores. This gradual shift is shaped by lived experience rather than trends, and it will likely influence how financial services adjust and expand in the years ahead as expectations continue to change.